What is the best money rule?

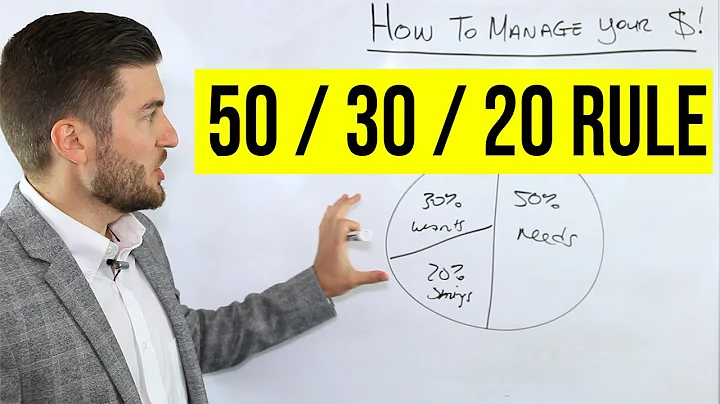

The 50-30-20 rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings. The savings category also includes money you will need to realize your future goals.

For many people, the 50/30/20 rule works extremely well—it provides significant room in your budget for discretionary spending while setting aside income to pay down debt and save. But the exact breakdown between “needs,” “wants” and savings may not be ideal for everyone.

The 70-20-10 budget formula divides your after-tax income into three buckets: 70% for living expenses, 20% for savings and debt, and 10% for additional savings and donations. By allocating your available income into these three distinct categories, you can better manage your money on a daily basis.

The 50/30/20 budget rule states that you should spend up to 50% of your after-tax income on needs and obligations that you must have or must do. The remaining half should be split between savings and debt repayment (20%) and everything else that you might want (30%).

The idea is to divide your income into three categories, spending 50% on needs, 30% on wants, and 20% on savings. Learn more about the 50/30/20 budget rule and if it's right for you.

Bottom Line. Living on $1,000 per month is a challenge. From the high costs of housing, transportation and food, plus trying to keep your bills to a minimum, it would be difficult for anyone living alone to make this work. But with some creativity, roommates and strategy, you might be able to pull it off.

If the 50/30/20 budget was once considered the golden standard of budgeting, it's not anymore. But there are budgeting methods out there that can help you reach your financial goals. Here are some expert-recommended alternatives to the 50/30/20.

The most common way to use the 40-30-20-10 rule is to assign 40% of your income — after taxes — to necessities such as food and housing, 30% to discretionary spending, 20% to savings or paying off debt and 10% to charitable giving or meeting financial goals.

The 40/40/20 rule comes in during the saving phase of his wealth creation formula. Cardone says that from your gross income, 40% should be set aside for taxes, 40% should be saved, and you should live off of the remaining 20%.

60/40. Allocate 60% of your income for fixed expenses like your rent or mortgage and 40% for variable expenses like groceries, entertainment and travel. 30/30/40.

What is the rule number 1 of money?

Warren Buffett once said, “The first rule of an investment is don't lose [money]. And the second rule of an investment is don't forget the first rule. And that's all the rules there are.”

The seven percent savings rule recommends saving seven percent of your gross salary each year. Gross salary is your income before any taxes, health insurance, retirement contributions, or other deductions are taken out of your paycheck.

The Four Fundamental Rules of Personal Finance

Spend less than you make. Spend way less than you make, and save the rest. Earn more money. Make your money earn more money.

For each payment order of $3,000 or more that a bank accepts as a beneficiary's bank, the bank must retain a record of the payment order.

A student guide to navigating the financial world

It is important to be prepared for what to expect when it comes to the four principles of finance: income, savings, spending and investment. "Following these core principles of personal finance can help you maintain your finances at a healthy level".

Yes, I can and do, but it depends on a person's circ*mstances. If you have a mortgage, a car payment and other bills, you may not be able to. If you live in an area where rents are high, you may not be able to. $100 a day equals $3000 a month and a lot of peoole live well on less than that.

You can retire comfortably on $3,000 a month in retirement income by choosing to retire in a place with a cost of living that matches your financial resources. Housing cost is the key factor since it's both the largest component of retiree budgets and the household cost that varies most according to geography.

Living on $2,000 per month is doable, but you won't be able to live just anywhere. This is important because at the time of writing the average Social Security benefit paid is $1,701 per month.

This goes back to a popular budgeting rule that's referred to as the 50-30-20 strategy, which means you allocate 50% of your paycheck toward the things you need, 30% toward the things you want and 20% toward savings and investments.

Zero-based budgeting (ZBB) is a budgeting technique in which all expenses must be justified for a new period or year starting from zero, versus starting with the previous budget and adjusting it as needed.

What are the four walls?

Personal finance expert Dave Ramsey says if you're going through a tough financial period, you should budget for the “Four Walls” first above anything else. In a series of tweets, Ramsey suggested budgeting for food, utilities, shelter and transportation — in that specific order.

Around the U.S., a $1 million nest egg can cover an average of 18.9 years worth of living expenses, GoBankingRates found. But where you retire can have a profound impact on how far your money goes, ranging from as a little as 10 years in Hawaii to more than than 20 years in more than a dozen states.

By age 40, your savings goals should be somewhere in the neighborhood of three times that amount. According to 2023 data from the U.S. Bureau of Labor Statistics, the average annual income hovers around $62,000. This means retirement savings goals for 40-somethings should tip the scales at around $200,000.

The 4% rule limits annual withdrawals from your retirement accounts to 4% of the total balance in your first year of retirement. That means if you retire with $1 million saved, you'd take out $40,000. According to the rule, this amount is safe enough that you won't risk running out of money during a 30-year retirement.

The 10% rule is a savings tip that suggests you set aside 10% of your gross monthly income for retirement or emergencies. If you still need to start a savings account, this is a great way to build up your savings. You should create a monthly budget before starting your savings journey.

References

- https://finance.yahoo.com/news/5-us-cities-where-retire-144820803.html

- https://cozinhacabral.com/20-10-rule-to-calculate-debt-limits/

- https://www.sofi.com/learn/content/70-20-10-rule/

- https://trb.bank/personal-finance/what-is-the-10-savings-rule/

- https://www.voya.com/tool/budget-calculator

- https://www.linkedin.com/posts/ginavega-mba-asesora-inversiones_what-is-the-iq-of-a-billionaire-the-average-activity-7114780230501703680-yKWL

- https://nypost.com/credit-cards/credit-card-habits-of-rich-people/

- https://www.lloydsbank.com/help-guidance/managing-your-money/50-30-20.html

- https://groww.in/blog/what-is-the-151515-rule-in-mutual-funds

- https://www.usaa.com/inet/wc/advice-finances-how-to-budget

- https://www.quora.com/Is-it-common-for-millionaires-or-billionaires-to-eventually-go-broke-Is-there-a-limit-to-how-much-money-can-be-spent-before-returning-to-poverty

- https://www.chase.com/personal/mortgage/education/buying-a-home/brrrr-method

- https://finance.yahoo.com/news/40-30-20-10-rule-132128106.html

- https://www.open.edu/openlearn/ocw/mod/oucontent/view.php?id=68098§ion=1

- https://www.investopedia.com/ask/answers/042315/what-difference-between-buy-limit-and-stop-order.asp

- https://bsaaml.ffiec.gov/manual/AssessingComplianceWithBSARegulatoryRequirements/09

- https://www.vsecu.com/blog/the-power-of-seven-a-complete-guide-to-the-seven-percent-savings-rule/

- https://www.nerdwallet.com/article/finance/how-to-budget

- https://www.investopedia.com/articles/personal-finance/121815/buffetts-9010-asset-allocation-sound.asp

- https://finance.yahoo.com/news/dave-ramsey-says-budget-four-180646522.html

- https://www.businessnewsdaily.com/2871-how-most-millionaires-got-rich.html

- https://www.bankrate.com/personal-finance/credit/bad-credit-score/

- https://www.cnbc.com/select/how-much-of-your-income-should-go-toward-investing/

- https://www.linkedin.com/pulse/how-rich-use-debt-avoid-taxes-get-richer-jake-hoffberg

- https://www.firsttechfed.com/articles/invest/why-do-the-wealthy-borrow

- https://www.caminofinancial.com/en/blog/business-managment/psychology-of-being-debt-free/

- https://www.healthline.com/health/diabetes/rule-of-15-diabetes

- https://www.gobankingrates.com/net-worth/debt/is-debt-free-the-new-rich/

- https://www.unfcu.org/financial-wellness/50-30-20-rule/

- https://twitter.com/DaveRamsey/status/1760389930201575883

- https://www.ncbi.nlm.nih.gov/pmc/articles/PMC10005910/

- https://www.huffpost.com/entry/jerome-kerviel-most-debt-in-the-world_n_2077219

- https://www.forbes.com/advisor/banking/budget-calculator/

- https://www.mindlessmag.com/post/inside-the-four-principles-of-finance

- https://www.medicalnewstoday.com/articles/hypoglycemia-rule-of-15

- https://www.beachhousewealth.com/article-the-20-20-60-rule

- https://positivemoney.org/issues/debt/

- https://www.businessinsider.com/personal-finance/80-20-rule

- https://www.cbsnews.com/news/retirement-savings-million-dollars-stretch-money-analysis-gobankingrates-years/

- https://money.com/average-american-personal-debt-amount/

- https://www.opploans.com/oppu/spending/how-do-millionaires-go-broke/

- https://www.bankrate.com/retirement/what-is-the-4-percent-rule/

- https://www.marketwatch.com/picks/this-is-warren-buffetts-first-rule-about-investing-heres-what-to-do-if-your-financial-adviser-breaks-that-rule-01635799738

- https://www.bankrate.com/personal-finance/debt/men-women-and-debt-does-gender-matter/

- https://www.citizensbank.com/learning/50-30-20-budget.aspx

- https://www.forbes.com/advisor/banking/savings/how-much-should-i-have-saved-by-30/

- https://time.com/personal-finance/article/50-30-20-rule/

- https://www.nerdwallet.com/article/finance/nerdwallet-budget-calculator

- https://www.livemint.com/money/personal-finance/mutual-fund-calculator-rs-10-000-monthly-sip-can-make-you-a-crorepati-heres-how-11696051366997.html

- https://www.opploans.com/oppu/credit-reports/can-bad-credit-even-good-income/

- https://www.quora.com/Could-you-live-on-100-a-day

- https://www.investopedia.com/articles/investing/062714/100-minus-your-age-outdated.asp

- https://n26.com/en-eu/blog/50-30-20-rule

- https://www.sofi.com/learn/content/50-30-20-budget/

- https://www.wsj.com/buyside/personal-finance/how-much-do-i-need-to-retire-f3275fa7

- https://www.gobankingrates.com/saving-money/savings-advice/what-is-the-golden-rule-of-saving-money/

- https://eringobler.com/80-20-rule/

- https://finance.yahoo.com/news/why-50-30-20-budget-120032412.html

- https://finance.yahoo.com/personal-finance/how-much-money-saved-by-40-155018155.html

- https://money.usnews.com/money/personal-finance/spending/articles/how-the-70-20-10-budget-rule-works

- https://finance.yahoo.com/news/grant-cardone-swears-40-40-110053843.html

- https://money.usnews.com/investing/articles/investing-for-teens-how-to-invest-money-as-a-teenager

- https://www.thinkbigfg.com.au/the-9-golden-rules-of-investing/

- https://www.gobankingrates.com/money/wealth/pay-off-debt-vs-invest-how-millionaires-prioritize/

- https://beyondyourhammock.com/rules-of-personal-finance/

- https://www.oracle.com/in/performance-management/planning/zero-based-budgeting/

- https://www.cnbc.com/select/how-much-money-you-should-save-every-paycheck/

- https://www.businessinsider.com/personal-finance/average-american-debt

- https://medlineplus.gov/ency/imagepages/19815.htm

- https://www.moneygeek.com/credit-cards/analysis/average-credit-card-debt/

- https://www.ramseysolutions.com/retirement/habits-of-millionaires-and-billionaires

- https://www.forbes.com/advisor/banking/guide-to-50-30-20-budget/

- https://www.bankrate.com/investing/golden-rules-of-investing/

- https://fiscalfitnessphx.com/follow-the-90-10-rule-when-it-comes-to-your-tax-refund/

- https://www.wsj.com/buyside/personal-finance/50-30-20-rule-budgeting-method-3d3ed0cf

- https://www.businessinsider.com/personal-finance/average-credit-score

- https://smartasset.com/investing/whats-a-good-return-on-investment-roi

- https://www.globalatlantic.com/professionals/thriving-practice/market-insights/rule-120

- https://localfirstbank.com/article/how-much-money-should-i-have-saved-by-the-time-i-am-30/

- https://smartasset.com/retirement/where-can-i-retire-on-3000-a-month

- https://www.sdflc.org/6-ways-maintain-debt-free-lifestyle/

- https://www.nasdaq.com/articles/the-10-10-80-rule:-is-this-savings-system-best-for-you

- https://www.prudential.com/financial-education/4-percent-rule-retirement

- https://wallethub.com/answers/cc/what-percentage-of-america-is-debt-free-2140664784/

- https://finance.yahoo.com/news/live-1-000-per-month-200011859.html

- https://www.investopedia.com/ask/answers/022916/what-502030-budget-rule.asp

- https://www.opers.org/financial-wellness/50-20-30-calculator/